Tax Magic of a Net Operating Loss

Hello, this is Noel Dalmacio, your ultimate CPA at lowermytaxnow.

Did you ever experience having a business or real estate sale that generated a substantial loss?

If that ever happened to you and you reported more business or real estate loss than your income, then, you may have a net operating loss.

That means you have the opportunity to apply your loss to either your past or future tax years to generate a refund or reduce your tax liability.

Unless you elected to carry the entire loss to future years, the general rule is you can use it to offset income in the two prior years, then carry forward the remainder, if any, for the next 20 years.

Here’s how it works. Your 2015 operating loss will first reduce the income you reported on your 2013 and 2014 federal income tax returns, potentially generating refunds for those years.

Any remaining 2015 operating loss can be used to offset income on future tax returns, beginning with the one you’ll file next April for 2016.

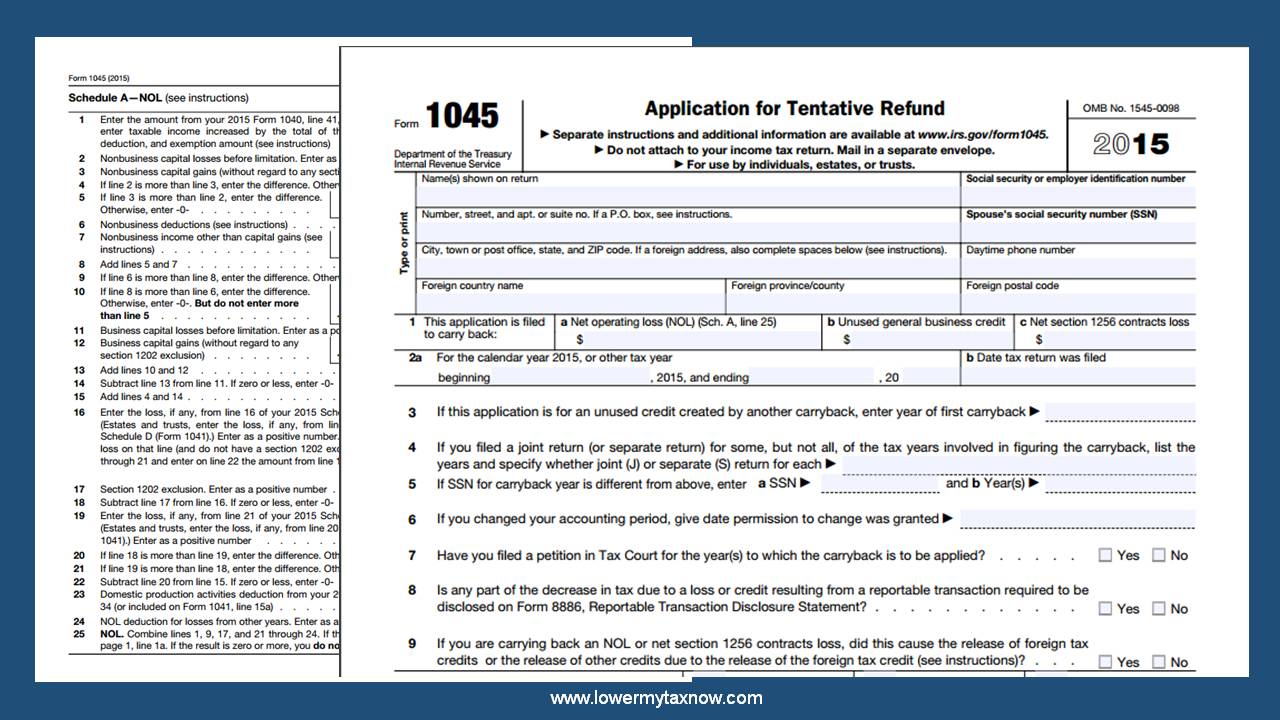

One way to claim the carryback is by using Form 1045, Application for Tentative Refund.

You must file Form 1045 within a year of the “loss year” – that is, by December 2016 for an operating loss reported on your calendar year 2015 tax return.

If you like to learn more, click the link lowermytaxnow.com and sign-in to receive my weekly blog.

Until then, this is Noel Dalmacio, your ultimate CPA at lowermytaxnow.com