Should You Make Estimated Tax Payments?

Hello, this is Noel Dalmacio, your ultimate CPA at lowermytaxnow.

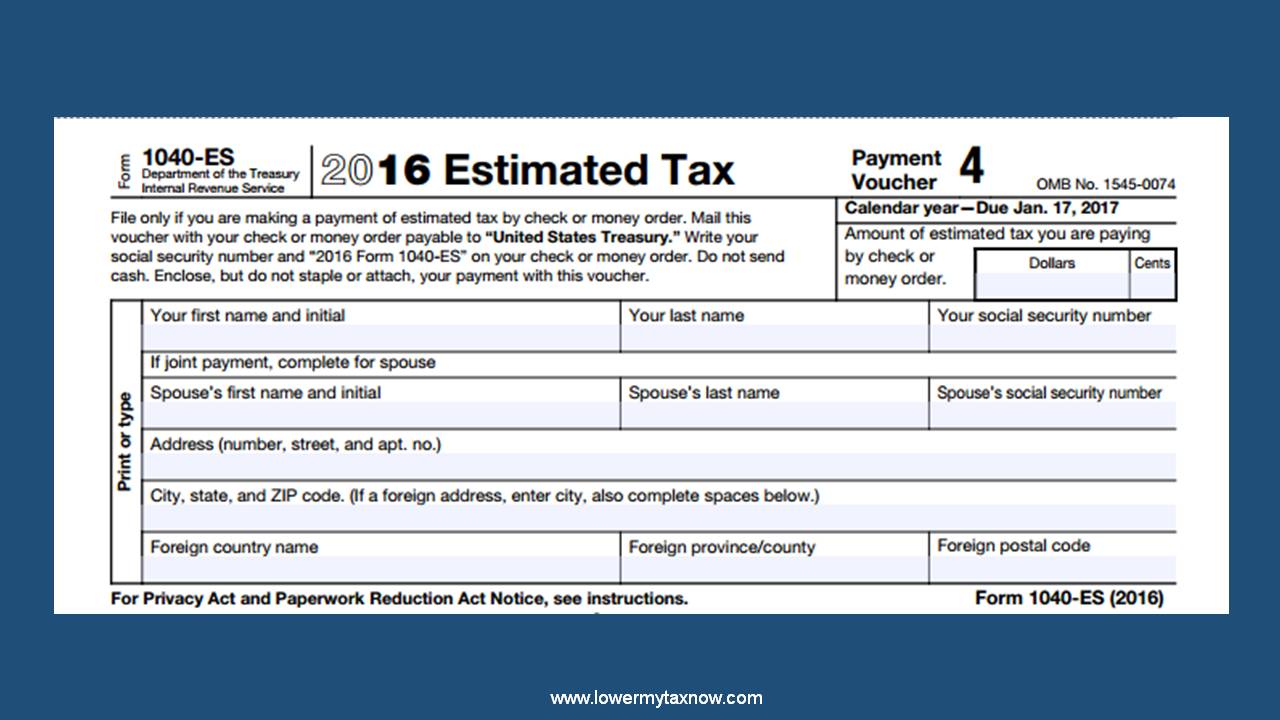

If you’re required to make quarterly estimated tax payments this year, the first one is due as the same date of the tax filing deadline.

Failing to pay estimates, or not paying enough, may lead to penalties. Here are three things you need to consider:

Do you need to make estimates? If you operate your own business, or receive alimony, investment, or other income that’s not subject to withholding, you may have to pay the tax due in installments. Each estimated tax installment is a partial prepayment of the total amount you expect to owe for next year. You make the payment yourself, typically four times a year.

How much do you need to pay? To avoid penalties, your estimated payments must equal 90% of your 2016 tax or 100% of the tax on your 2015 return (110% if your adjusted gross income was over $150,000).

Exceptions. There are exceptions to the general rule. For instance, say you anticipate the balance due on your 2016 tax return will be less than $1,000 after subtracting withholding and credits. In this case, you can skip the estimated payments.

If you like to learn more, click the link lowermytaxnow.com and sign-in to receive my weekly blog.

Until then, this is Noel Dalmacio, your ultimate CPA at lowermytaxnow.com