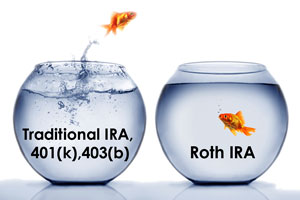

Roth Conversions are Taxable

If you convert a traditional IRA to a Roth, there’s a price to pay. Converted amounts attributable to tax-deductible contributions, plus all of the earnings, are taxable at ordinary income rates. To lessen the tax hit, you may choose to convert only a part of your IRA to a Roth. You can convert as much as you like, or you can convert some each year if that seems advisable.