Foreign Account Reporting by June 30

Hello, this is Noel Dalmacio, your ultimate CPA at lowermytaxnow.

If you hold foreign bank or financial accounts, or have signature authority over such accounts, and the total value of all your accounts exceeds $10,000 at any time during the calendar year, you may be required to file a Treasury Department report known as the FBAR.

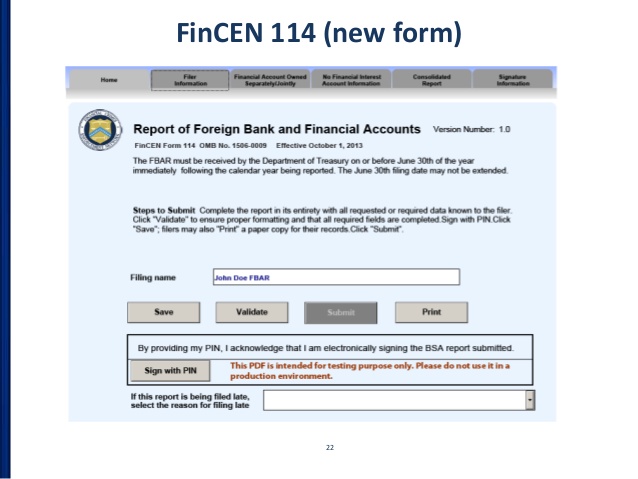

It’s easy to overlook this requirement because it’s separate from your federal income tax filing, with a different deadline and strict rules.”FBAR” refers to Form 114, Report of Foreign Bank and Financial Accounts. Your Form 114 must be filed electronically with the Treasury Department no later than June 30. No filing extension is available. So, please watch out for the filing requirement due date.

Until then, this is Noel Dalmacio, your ultimate CPA at lowermytaxnow