FBAR deadline is June 30

If you hold foreign bank or financial accounts and the total value of your account exceeds $10,000 at any time during the calendar year, you may be required to file a Treasury Department report known as the FBAR. It’s easy to overlook this requirement because it’s separate from your federal income tax filing, with a different deadline and strict rules.

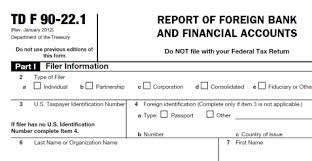

FBAR refers to “Form 114, Report of Foreign Bank and Financial Accounts.” That form is new this year, replacing the prior Form 90-22.1.

Your 2013 Form 114 must be filed electronically with the Treasury Department no later than June 30, 2014. No filing extension is available. Contact us if you need details or filing assistance.