Does your business need to file Form 1099?

Does your business need to file Form 1099?

Hello, this is Noel Dalmacio, your ultimate CPA at lowermytaxnow.com

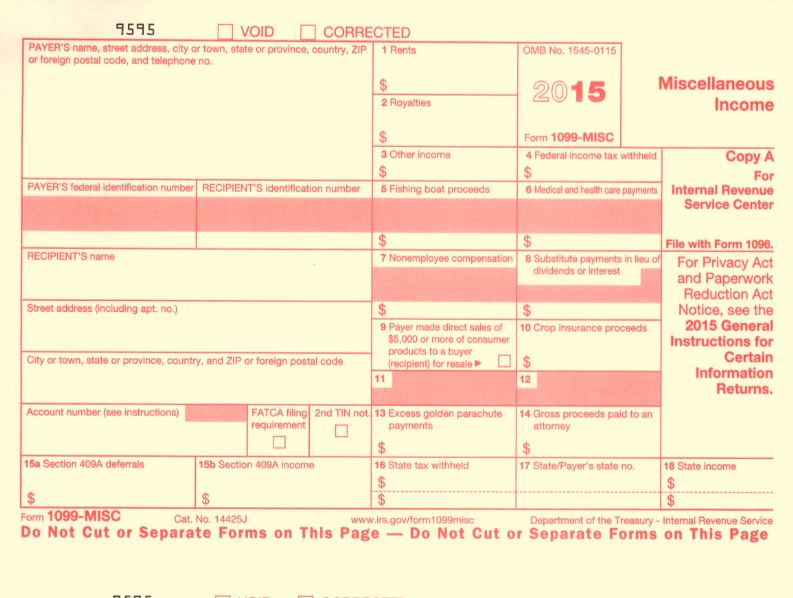

Forms 1099 are due to recipients by February 1, 2016. You may be most familiar with Form 1099-MISC, which you use when your business makes payment over $600 for services to nonemployees. Reportable payments can include fees for services paid to independent contractors, such as consultants, lawyers, cleaning services, landlords and property managers. Generally, you don’t report fees paid to corporations, but there are exceptions (payments to lawyers, for example). Lastly, you are required to issue a 1099 to an LLC unless they are tax as a corporation.

If you like to learn more, click the link lowermytaxnow.com and subscribe to my weekly blog.

Until then, this is Noel Dalmacio, your ultimate CPA at lowermytaxnow.com